The creation of Grameen Bank in 1983

Microcredit has been Bangladesh's most famous export

In a free society, a man’s value and remuneration depends not on capacity in the abstract but on success in turning it into concrete service that is useful to others who can reciprocate.

- Friedrich Hayek

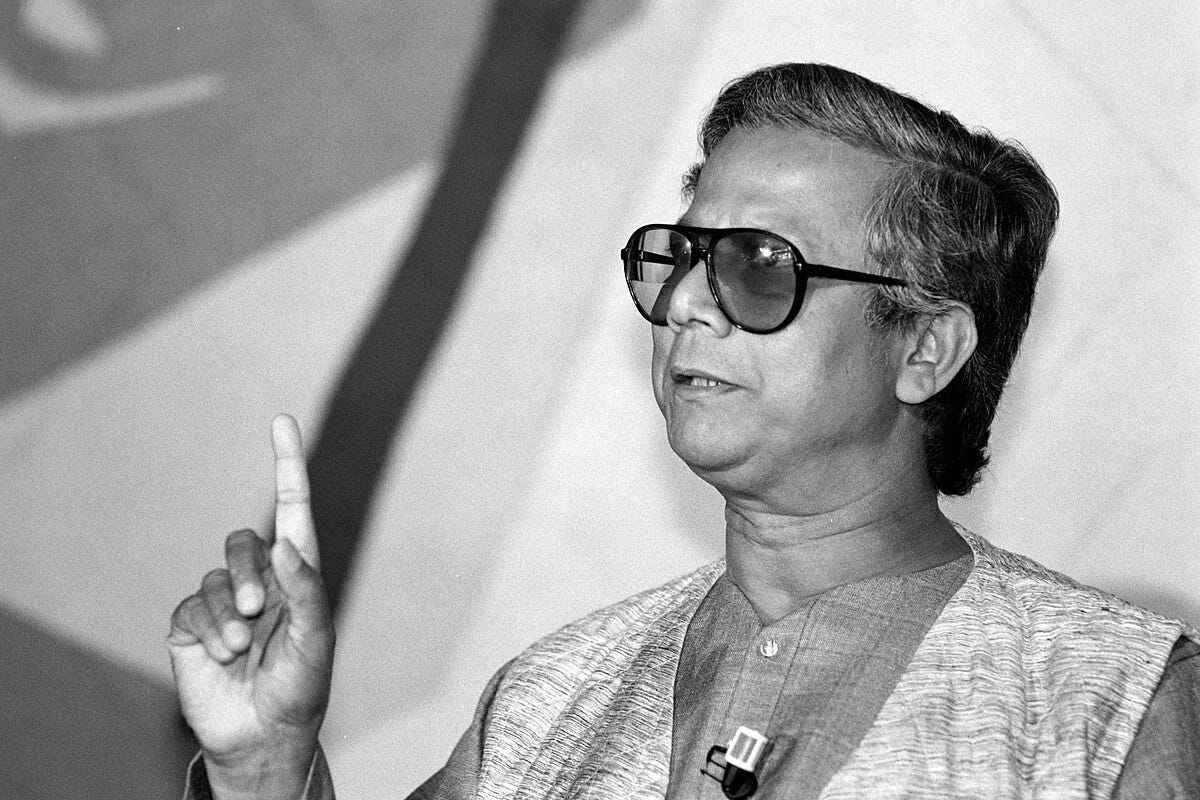

Muhammad Yunus was a student of economics at Vanderbilt University in the United States during the Bangladesh War of Independence in 1971. Drawn to the plight of his war ravaged homeland, Yunus set up the Bangladesh Information Center to spread awareness of the humanitarian crisis in East Pakistan. He ran the Bangladesh Information Center and published the Bangladesh Newsletter. After returning to his liberated homeland, he joined Chittagong University’s economics faculty. Yunus set his sights on alleviating poverty which has been Bangladesh’s greatest challenge. He was shocked by a famine which occurred under the Awami League’s rule in 1974.

By 1976, coinciding with the free market reforms that overturned the Awami League’s socialism, Yunus began experimenting with microcredit. This involved lending out small loans to the poorest rural people who could not afford to take loans from banks and financial institutions. The idea was to spur entrepreneurial activity among the poorest section of society to generate income for self-sufficiency, and bring people out of the misery of poverty. Yunus began his experiment in the village of Jobra near Chittagong. In the late 1970s, he extended his efforts to other districts and took on a nationwide outreach. His efforts complemented the policy of post-1975 regimes in Bangladesh which encouraged private enterprise. Microcredit provided the capital for rural borrowers to generate income from agriculture, horticulture, dairy, and handicrafts. Yunus began his experiment with only $27 for his first loans.

Yunus appealed to the government of the day to give an institutional shape to the emerging financial institution. Yunus advocated a bank for the poor and owned by the poor. For this to happen, a new law was required for a new kind of bank. The erstwhile finance minister A. M. A. Muhith accepted the proposal and told Yunus to submit a legal framework to the finance ministry. Yunus turned to the author of Bangladesh’s constitution, Dr. Kamal Hossain, for a drafting a legal framework. He was taken to Dr. Hossain’s chamber by his former student and colleague Mozammel. Dr. Hossain understood the significance of the work Yunus was doing even though both men never worked together before. The promotion of economic self-sufficiency, poverty alleviation and women empowerment were necessary to achieve the constitutional goals of social justice which was articulated during the Liberation War and later in the provisions on social policy in the Constitution. Social justice was an ideal of Bangladesh’s Proclamation of Independence in 1971.

Dr. Hossain produced several drafts keeping in mind banking laws. Yunus and Dr. Hossain hammered out the details of the draft legal framework before settling on the final draft. The draft was submitted to the finance ministry for approval. Dr. Hossain’s role in drafting the Grameen Bank Ordinance was recounted to me by Dr. Sharif Bhuiyan during the 88th birthday celebration of Dr. Hossain at the chamber.

Recognizing the success and efforts of Yunus in poverty alleviation, the government established a unique financial institution to provide microcredit. The bank was established by the Grameen Bank Ordinance in 1983 under the martial law regime. Grameen Bank means “village bank”. The ordinance was enacted on 4 September 1983. The martial law regime was presided over by President A. F. M. Ahsanuddin Chowdhury, while Lieutenant General Hussain Muhammad Ershad was the Chief Martial Law Administrator. Yunus was awarded Bangladesh’s highest civilian honor in 1987 when President Ershad bestowed him with the Independence Award.

Microcredit broadened the scope for credit to expand small businesses and agriculture. Agricultural production has been a key driver of Bangladesh’s economic growth. Small businesses also form the backbone of the Bangladeshi economy. By the 1990s, the Grameen Bank had millions of borrowers across Bangladesh. Most of its borrowers are women. The success of Grameen was replicated across the world. Bill Clinton, while as Governor of the U.S. state of Arkansas, invited Yunus to launch microcredit in America. I had the opportunity to meet the President of Grameen China who informed me about the travels of Yunus in China to promote microcredit. From Pakistan to Russia to Costa Rica to Tanzania, microcredit is playing a vital role in poverty alleviation and lifting millions of people out of poverty. Microcredit has been Bangladesh’s most famous export. Yunus has been Bangladesh’s most acclaimed citizen. Yunus and the Grameen Bank were awarded the Nobel Peace Prize in 2006 for “for their efforts to create economic and social development from below”.

When Bangladesh’s prime minister Sheikh Hasina grew increasingly authoritarian, Yunus was perceived as a threat to the Awami League. Yunus was booted out of Grameen Bank in 2011 to the shock of most of the country and the world. Hasina’s government began to interfere in Grameen Bank’s management. Hasina’s control of the judiciary meant there was no relief from the courts. Yunus turned to Dr. Hossain once again. At the chamber, Dr. Hossain instructed his team to work through the night for the legal defense of Yunus. Dr. Hossain, Sara Hossain, Tanim Hussain Shawon and others spent the entire night working on the case.

The Grameen Bank Ordinance was repealed and replaced by a draconian legislation in 2013. Most Bangladeshis became frozen and speechless at this sight. It was a distressing and dumbfounding sight to see the Awami League destroy the greatest achievements of Bangladesh. It was ironical that A. M. A. Muhith, the man responsible for promulgating the Grameen Bank Ordinance in 1983, was part of the government that sought to destroy Grameen Bank under Sheikh Hasina.

I remember my mother joined a rally in 2011 in support of Yunus while my father met him in person at his home to express solidarity. My father met him several times over the years. My parents’ strong solidarity with Yunus did not go down well with the Awami League elite. Years later, when I advocated reforms and a new generation of leaders for the Awami League through my writings, I remained unwavering in my support for Yunus. I rejected requests from Sheikh Hasina’s office to speak against Yunus. Instead, I clearly sided with Yunus through my posts on social media. At my law firm, our deputy head of chambers Sara Hossain joined court proceedings when Yunus was summoned to the Labour Court over politically-motivated cases.

Yunus has answered his country’s call once more. As he shepherds Bangladesh out of the shadows of oppression, he is restoring human rights, demanding accountability, and laying the foundations for a just and free society

- Hillary Rodham Clinton

My father and I discussed Yunus, microcredit and the Grameen Bank in a podcast a few days before Sheikh Hasina’s government collapsed. After Sheikh Hasina resigned and fled the country, Yunus was requested by student leaders of the Bangladeshi revolution to lead the interim government. The Yunus-led interim government has embarked on a historic reform process as part of the restoration of democracy and transition to a new chapter in Bangladesh’s history.

“Yunus has answered his country’s call once more. As he shepherds Bangladesh out of the shadows of oppression, he is restoring human rights, demanding accountability, and laying the foundations for a just and free society”, wrote Hillary Rodham Clinton in TIME magazine when Yunus was selected as one of the 100 most influential people of 2025. When the erstwhile US first lady came to Dhaka to see Grameen’s operations during a 12-day tour in 1995, my parents took me to her hotel to say hello to her. You could say I have experienced some of the Yunus star power from an early age!

Thankfully, history and destiny have been kind. Yunus will get a chance to salvage his Grameen project from the clutches of Bangladesh’s dystopia.

Footnotes

A Man of the World by Muhammad Yunus in Essays In Honour of Dr. Kamal Hossain. Bangladesh: Emergence and Development. Edited by Mirza Hassan, Asif Nazrul and Sharif Bhuiyan. 147-148

Note: The first internship I undertook in life was at the Grameen Bank while I was still at high school. I worked with Grameen’s microcredit and renewable energy programs. I also had the opportunity to meet Prof. Dr. Muhammad Yunus. My picture with Dr. Yunus is tucked away somewhere in my mother’s closet which I am not able to locate. I used the picture as my profile picture on Facebook before shutting down the previous account in 2016. A copy of the photograph should also remain in either Grameen Bank’s or Yunus Centre’s archives.